Healthcare Cloud Computing Market Size, Share & Trends by Product (EHR, VNA, RIS, LIS, RCM), Deployment (Private, Public), Component (Software, Service), Pricing (Spot), Service Model (SaaS, IaaS, PaaS), End User (Provider (Hospital), Payer) - Global Forecast to 2029

Healthcare Cloud Computing Market Size, Share & Trends

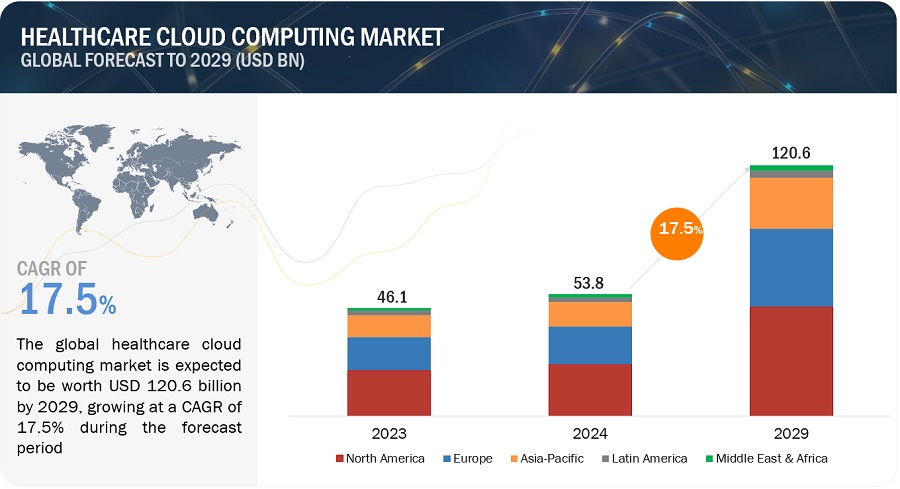

The size of global healthcare cloud computing market in terms of revenue was estimated to be worth $53.8 billion in 2024 and is poised to reach $120.6 billion by 2029, growing at a CAGR of 17.5% from 2024 to 2029. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

The healthcare cloud computing market is experiencing significant growth, primarily due to several factors. These include the increased adoption of electronic health records (EHR), e-prescribing, telehealth, mobile health (mHealth), and other healthcare IT solutions. Additionally, the market is benefiting from the rising use of big data analytics, wearable devices, and the Internet of Things (IoT) in healthcare, as well as the growing trend of cloud deployment in the industry. Cloud computing offers advantages such as better data storage, flexibility, and scalability, along with the cost-efficiency it provides, aligning with the proliferation of new payment models and the dynamic nature of health benefit plan designs.

However, the market also faces challenges, including data security concerns and the complexity of regulations governing cloud data centers, which are expected to limit the market's growth to some extent.

Healthcare Cloud Computing Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare Cloud Computing Market Overview

Healthcare Cloud Computing Market Dynamics

Driver: The surging popularity of health IT solutions like EHRs, e-prescribing, and telehealth platforms.

Globally, there has been a significant increase in the prevalence of chronic diseases like cancer, cardiovascular diseases (CVD), and diabetes over the past few decades. According to the World Health Organization (WHO) in 2016, CVD stands as the primary cause of death worldwide, resulting in 17.3 million deaths annually. Projections suggest this number will rise to over 23.6 million by 2030, with 7.4 million attributed to coronary heart disease and 6.7 million to stroke. Additionally, according to GLOBOCAN, the annual number of new cancer cases is expected to climb to 19.3 million by 2025, up from 14.1 million in 2012.

The escalating global geriatric population is a significant driver behind the increased prevalence of these chronic conditions. WHO forecasts indicate that between 2015 and 2050, the global geriatric population (aged over 60) will nearly double, reaching 22% of the total global population, approximately 2 billion by 2050. According to the National Council on Aging, around 92% of older adults have at least one chronic ailment, with 77% affected by two or more.

The pandemic has exacerbated the strain on healthcare systems worldwide. Hospitals are under immense pressure to establish well-coordinated environments where all clinical devices are interconnected, and collaboration with other healthcare entities is seamless. After the effects of pandemic, there's an increasing demand for remote monitoring of affected individuals. Temporary healthcare facilities are being established globally to address rising case numbers, yet many lack essential infrastructure for effective nurse-patient communication. This pandemic has driven the demand not only for hospital capacity management solutions but also for telehealth and mobile health (mHealth) solutions, e-prescribing, and Electronic Health Record (EHR) systems, both in developed nations and emerging economies like the Asia-Pacific region.

Consumer adoption of telehealth has skyrocketed, with the percentage of US consumers using telehealth rising from 11% in 2019 to 46% in 2020, as a substitute for canceled in-person healthcare visits. Similarly, at MyDoc, a Singapore-based telemedicine platform, monthly active users surged by 272% from January 2019 to January 2021.

Restraint: Rising data security and privacy concerns.

One of the primary apprehensions associated with cloud solutions is the perceived inferior security of vendor-hosted data compared to on-premise storage. Given the sensitive nature of patient information, strict privacy protocols must be upheld to limit access solely to authorized personnel. Legal frameworks like HIPAA in the US and various directives in the EU, aimed at data protection, underscore the importance of safeguarding patient data. Additionally, in many jurisdictions, regulations such as the requirement that Protected Health Information (PHI) remains within national borders, as seen in Canada's PIPEDA, emphasize the need for stringent compliance to avoid legal repercussions.

Despite the array of benefits and security features offered by cloud technology, data stored in the cloud remains susceptible to cyber threats. The exponential growth in patient data and the healthcare sector's push toward digitalization have only exacerbated concerns regarding data security and privacy. Furthermore, patients themselves are increasingly anxious about the safety of their personal information, further highlighting the imperative of maintaining robust security measures. While public clouds encounter similar security vulnerabilities as traditional IT systems, they are met with reluctance due to these concerns. Although private clouds offer enhanced access controls and security systems, skepticism persists within the healthcare industry regarding their efficacy in safeguarding data.

Opportunity: The rise of telecloud and telehealth consultations.

The integration of wireless technology with cloud computing has emerged as a robust solution for delivering healthcare services to remote areas. In numerous countries, the majority of physicians and specialists are concentrated in urban centers, leaving rural regions underserved in terms of advanced medical care. This challenge can be effectively tackled through the implementation of telecloud systems, enabling healthcare professionals to remotely diagnose and treat patients across vast distances in real time and at affordable rates.

Amid the pandemic and the highly contagious nature of the disease, clinicians have intensified their focus on remote monitoring of patients. The risks associated with in-person interactions have become increasingly evident, with a growing number of healthcare workers contracting the virus despite adhering to safety protocols. For instance, in March 2020, the Italian Doctors Association reported that at least 50 physicians lost their lives while treating COVID-19 patients. Hence, reducing reliance on physical assistance and promoting telehealth has become imperative. Consequently, telehealth solutions encompassing remote patient monitoring and interactive treatments are anticipated to gain significant traction in the foreseeable future.

Additionally, Cisco is providing support to over 17,000 healthcare organizations across 118 countries for telehealth and remote patient monitoring. With healthcare providers increasingly recognizing the benefits of telehealth, the adoption of telecloud solutions is projected to surge in various countries, presenting lucrative growth prospects for stakeholders in the healthcare cloud computing market.

Challenge: Increasing challenges with interoperability and portability

Ensuring easy and swift access to patient data stands as a crucial requirement for any hospital or healthcare institution. When a hospital transitions its data to the cloud, it becomes housed within systems and platforms managed by the service provider, potentially introducing interoperability challenges. The primary hurdle to achieving cloud computing interoperability lies in the Cloud APIs and interfaces. The absence of standardized protocols among cloud service providers hampers seamless data exchange between various cloud-based tools, leading to issues of data portability.

For example, when a patient's data is stored by one healthcare provider who subsequently refers the patient to another medical facility or specialized clinic, the receiving hospital should ideally be able to access the patient's health records stored on a different cloud platform. To ensure optimal efficiency, it is essential to establish a high level of interoperability and standardization across healthcare solutions operating in the cloud. Major corporations like Oracle and Amazon Web Services are actively working to address this challenge. In 2019, Oracle unveiled plans for a cognitive healthcare platform aimed at tackling interoperability issues by automating processes, thus reducing the reliance on manual interventions. This initiative, known as "Project Apollo," is currently under development.

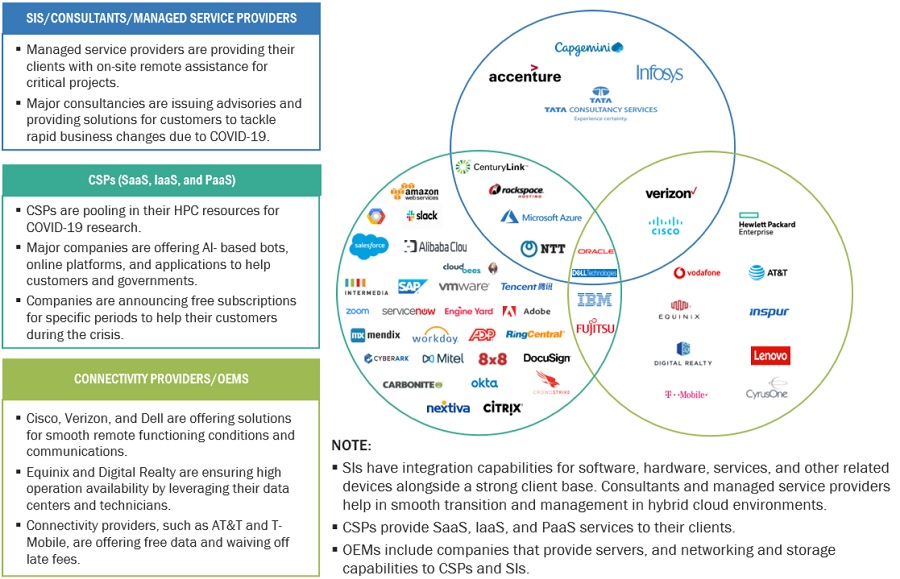

Healthcare Cloud Computing Industry Ecosystem

This section showcases the primary participants within the market, encompassing connectivity providers, OEMs, hardware suppliers, laaS/PaaS/SaaS providers, consultants, integrators, and managed service providers. Within this section, there's an overview of companies providing services and solutions in the cloud market, detailing recent company advancements, alongside Marketsand Markets' assessment of these vendors. Additionally, it underscores each company's distinctive features and expertise within the market.

The healthcare provider segment accounted for the largest share in the healthcare cloud computing industry, by product.

In 2023, the healthcare provider sector held the majority stake in the healthcare cloud computing market. This dominance primarily stems from the increased integration of various healthcare IT solutions prompted by the pandemic, alongside heightened acceptance of technological innovations in health IT. Moreover, the transition to value-based care and the heightened focus on patient outcomes are prompting healthcare providers to embrace cloud solutions that support telemedicine, mobile health applications, and integrated care models. The need to comply with stringent regulatory standards, such as HIPAA in the U.S., further accelerates the adoption of cloud technologies, which offer built-in security and compliance features.

SaaS segment accounted for the largest market share by the service model of healthcare cloud computing industry.

In 2023, the software-as-a-service (SaaS) sector emerged as the predominant segment within the healthcare cloud computing market. This prominence can be attributed to factors such as improved security measures and the minimized initial capital expenditures linked with the SaaS model. This model allows healthcare organizations to access advanced applications and services via the internet, ensuring easy implementation and minimal maintenance burdens. Additionally, SaaS solutions support interoperability and data sharing across different systems and locations, which is crucial for integrated care and enhanced patient outcomes. The flexibility, accessibility, and comprehensive nature of SaaS make it the preferred choice for many healthcare organizations, driving its dominant share in the healthcare cloud computing market.

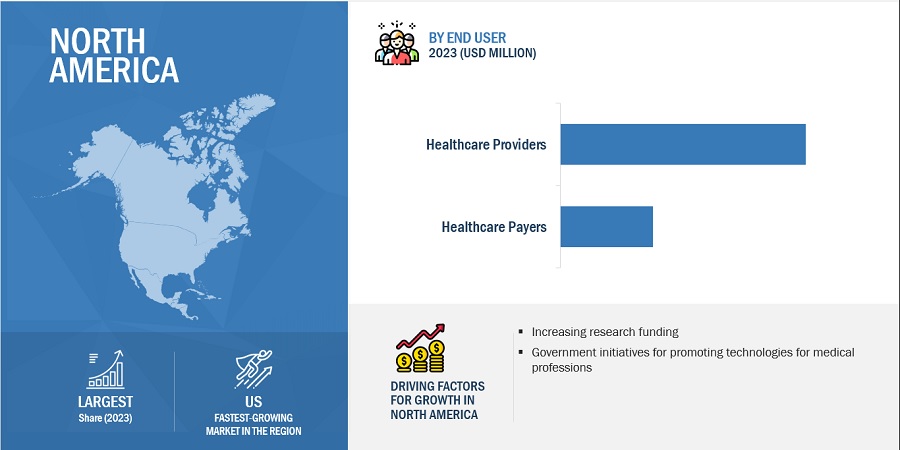

North America accounted for largest market share of the healthcare cloud computing industry in 2023.

In 2023, North America dominated the healthcare cloud computing market, boasting the largest share. This was propelled by factors including technological progress, incentivized Electronic Health Record (EHR) initiatives by Medicaid & Medicare, and substantial healthcare spending in the region.

Moreover, the Asia Pacific region exhibited the most rapid growth within the healthcare cloud computing market, throughout the forecast period. This surge is fueled by factors such as heightened adoption of digital health solutions across Asia, ongoing modernization efforts in the healthcare infrastructure of China, and the burgeoning healthcare sector in India.

North America - Healthcare Cloud Computing Market Overview

To know about the assumptions considered for the study, download the pdf brochure

The healthcare cloud computing market key established players include Amazon Web Services, Inc. (US), Microsoft (US), Google, Inc. (US), athenahealth. Inc. (US), CareCloud, Inc. (US), Siemens Healthineers AG (Germany) among others.

Scope of the Healthcare Cloud Computing Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$53.8 billion |

|

Projected Revenue by 2029 |

$120.6 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 17.5% |

|

Market Driver |

The surging popularity of health IT solutions like EHRs, e-prescribing, and telehealth platforms. |

|

Market Opportunity |

The rise of telecloud and telehealth consultations. |

The study categorizes healthcare cloud computing market to forecast revenue and analyze trends in each of the following submarkets:

By Segment

-

Products

-

Healthcare Provider Solutions

-

Clinical Information Systems

- EHR/EMR

- PACS and VNA

- PHM solutions

- Telehealth solutions

- RIS

- LIS

- PIS

- Other clinical information systems

-

Non-Clinical Information Systems

- RCM solutions

- Financial management solutions

- HIE solutions

- SCM solutions

- Billings & accounts management solutions

- Other non-clinical information systems

-

Clinical Information Systems

-

Healthcare Payer Solutions

- Claims management solutions

- Payment management solutions

- CRM solutions

- Provider network management solutions

- Fraud management solutions

-

Healthcare Provider Solutions

-

Component

-

Services

- Consulting services

- Implementation services and ongoing it support

- Training and education services

- Post-sales and maintenance services

- Software

-

Services

-

Deployment model

- Private cloud

- Hybrid cloud

- Public cloud

-

Pricing model

- Pay-as-you-go

- Spot pricing

-

Service model

- Software-as-a-service

- Platform-as-a-service

- Infrastructure-as-a-service

-

End User

-

Healthcare providers

- Hospitals

- Pharmacies

- Diagnostic and Imaging Centers

- Ambulatory Centers

-

Healthcare payers

- Public payers

- Private payers

-

Healthcare providers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

-

Middle East & Africa

- GCC

- RoMEA

Recent Developments of the Healthcare Cloud Computing Industry:

- In February 2022, IBM (US) completed the acquisition of Neudesic, LLC (US), with the goal of expanding its range of hybrid multi-cloud services and advancing its hybrid cloud and AI strategies.

- In February 2022, Lyniate (US) acquired SAP SE (Germany) to provide technology and consulting expertise, facilitating clients in adopting a hybrid cloud approach and transitioning mission-critical workloads from SAP solutions to the cloud, particularly for regulated and non-regulated industries.

- In January 2022, Francisco Partners (US) entered into an agreement with IBM (US) to acquire various healthcare data and analytics assets from IBM, currently part of the Watson Health business. These assets include Health Insights, MarketScan, Clinical Development, Social Program Management, Micromedex, and imaging software offerings.

- In January 2022, IBM (US) acquired ENVIZI (Australia) to strengthen its portfolio of AI-powered software, aligning with IBM's ongoing investments in this domain..

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

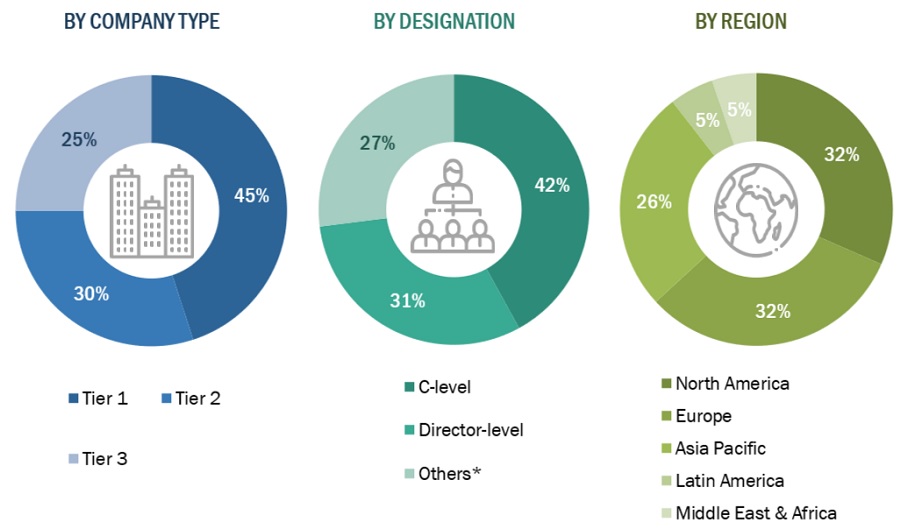

This research study involved the extensive use of both primary and secondary sources. It involved the analysis of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study extensively utilized secondary sources, including directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, as well as white papers, annual reports, and companies' house documents. The aim of the secondary research was to gather and analyze information for a comprehensive and commercially focused study of the healthcare cloud computing market, encompassing technical aspects and market dynamics. It also facilitated the identification of key players, market classification, industry trends, geographical markets, and significant market-related developments. Additionally, a database of prominent industry leaders was compiled through secondary research.

Primary Research

In the primary research process, various supply-side and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the healthcare cloud computing market. Primary sources from the demand side included personnel from pharmaceutical & biotechnology companies, research institutes and hospitals (small, medium-sized, and large hospitals).

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the healthcare cloud computing market was determined after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Global Healthcare Cloud Computing Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Healthcare Cloud Computing Market Size: Bottom-Up Approach

Data Triangulation

The size of the healthcare cloud computing market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

- Revenues for individual companies were gathered from public sources and databases.

- Shares of leading players in the healthcare cloud computing market were gathered from secondary sources to the extent available. In certain cases, shares of healthcare cloud computing businesses have been ascertained after a detailed analysis of various parameters including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

- The total revenue in the healthcare cloud computing market was determined by extrapolating the market share data of major companies.

Market Definition

Cloud computing involves the storage, management, and processing of data from disparate locations and delivering that data to hosted services over the Internet. It provides on-demand access to software applications, resources, and services through the internet.

Cloud computing in healthcare describes the practice of implementing remote servers accessed via the internet to store, manage, and process healthcare-related data.

Key Stakeholders

- Healthcare IT service providers

- Healthcare insurance companies/payers

- Healthcare institutions/providers (hospitals, medical groups, physician practices, diagnostic centers, and outpatient clinics)

- Healthcare startups, consultants, and regulators

- Research and development (R&D) companies

- Business research and consulting service providers

- Venture capitalists

- Government agencies

- Accountable care organizations

Objectives of the Study

- To define, describe, and forecast the healthcare cloud computing market based on product, deployment model, service model, pricing model, component, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall healthcare cloud computing market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely,

- North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa.

- To profile the key players and analyze their market shares and core competencies2

- To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, and collaborations in the overall healthcare cloud computing market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific healthcare cloud computing market into Australia, Taiwan, New Zealand, Thailand, Singapore, Malaysia, and other countries

- Further breakdown of the Rest of Europe healthcare cloud computing market into Russia, Austria, Finland, Sweden, Turkey, Norway, Poland, Portugal, Romania, Denmark, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Cloud Computing Market

This market study is a complete guide to the Cloud Computing Healthcare market.